KYC360 wins Wealth Management category in the Chartis FCC50®

KYC360 wins Wealth Management category in the Chartis FCC50®

Learn more

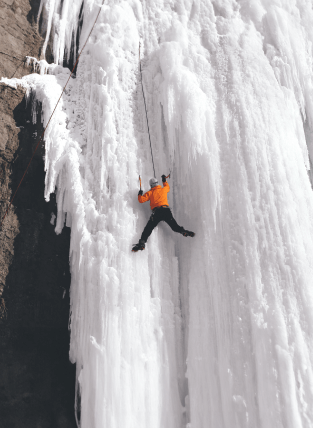

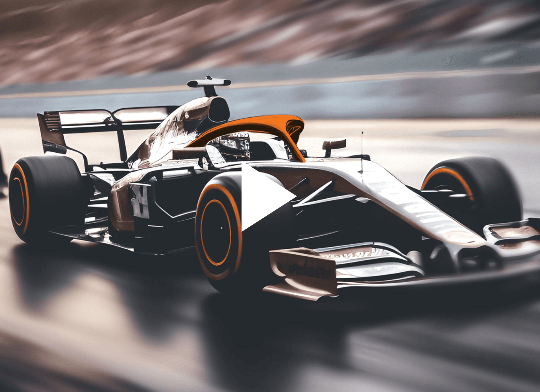

Comply and Outperform

Onboarding, screening and pKYC at the speed of business.

Compliance was a brake. With KYC360’s award winning technology compliance can be an accelerator.

Transform compliance into a competitive advantage

Reduce time to value, enhance customer experience and drive operational efficiencies with solutions designed by industry experts.

Judged by Chartis to be the world’s leading onboarding solution for the wealth Management industry our onboarding solution can help you blaze a path to doing, more better business faster.

Do more, better business faster with the KYC360 Platform

Architected for rapid deployment with guaranteed rapid ROI the KYC360 end to end no code SaaS platform is flexible, fully configurable and modular so that you option and pay only for the functionality you need.

What are you looking to achieve?

KYC360 offers much more than world class onboarding, screening and pKYC solutions. Whatever outcomes you are trying to achieve from your compliance processes, we can help you.

Drive operational efficiencies

Rapid ROI

Master Complexity

Dramatically improve CX

Benefit from a knowledge network like no other

Knowledge Hub

Community -

Knowledge is Power

Knowledge is Power

Drawing on our subject matter expertise and our many customerand partner relationships globally we deliver valuable insights through weekly KYC newsletters, white papers, podcasts and events.

Explore the community

Roundup

KYC360 Weekly Roundup - 26th Apr 2024

Top stories this week: New report from PWC shows financial firms are unclear about AML regulations fraud | UK MP warns of ‘dirty money epidemic’

KYC360

Apr 26, 2024

News

KYC360 appoints former Director-General of Jersey Financial Services Commission (JFSC) to advisory board

KYC360 is delighted to announce the appointment of John Harris to our advisory board.

KYC360

Apr 22, 2024