About the Client

Founded in early 2018, our client is a specialist emerging markets investment advisor. Its team of experts has decades of experience and a deep knowledge of emerging markets, private equity, asset management, and legal and governance matters.

Today, our client focuses on delivering added value to investments, based on a risk-adjusted approach. Its existing and planned network of operational offices in emerging markets means it now has an extensive global reach.

Its key decision-makers are always on the ground when it counts, and this helps to ensure investment and execution recommendations and decisions are always made using robust, timely, and relevant information.

The Challenge

The Challenge

A new money laundering reporting officer (MLRO) had been appointed and upon their arrival immediately realised that the company needed to dramatically improve and update its onboarding processes.

The MLRO was faced with a situation whereby the existing processes and procedures simply weren’t capable of screening for risk at the level that the sector demanded. The compliance teams needed a new system that would not only allow them to function collaboratively but also provide flexible permissions hierarchies, so that the processes could be tailored to meet the needs of individual customers and markets.

Confronted by a slow, disjointed, manual onboarding process which lacked sophistication, the MLRO realised that changes would have to be made if the company was to meet all of its statutory anti-money laundering (AML) requirements and regulations.

To add to the challenge, the organisation was expanding into emerging markets in Africa, a move which greatly accelerated the need to implement a new automated onboarding process.

Furthermore, with offices both in the UK and abroad, there was a growing need to implement a seamless process that would be accessible by all stakeholders, regardless of their geographical location.

The Solution: Onboarding

The Solution: Onboarding

The MLRO looked to the market for a solution and quickly realised that KYC360 Onboarding would provide the solution they were looking for.

With real-time customer verification, the new onboarding solution would solve all the organisation’s existing issues while delivering a streamlined and efficient process fit for future growth.

The implementation of the onboarding environment started with a blank sheet. The first step was to have in-depth conversations with all relevant stakeholders in order to fully understand the requirements of the organisation. From here, it would enable the KYC360 implementation team to produce a blueprint that would form the basis for the building of the bespoke software package.

After the initial analysis, the design was tailored to ask for a different set of requirements depending on the customers they were looking to onboard. These requirements included areas such as whether a potential customer was a regulated or unregulated entity, the sector they operated in, and the jurisdiction that they resided in.

KYC360 implementation team then set about training specific personnel who were entrusted with decision-making capabilities, in order to be able to test the system through its initial stages. This provided them with the opportunity to add, subtract, or simply fine tune the onboarding questions.

Only after this intensive testing phase had been completed were we able to roll out the system across the entire organisation.

The Results

The Results

Unlike the old paper processes, the new digital setup now prohibits and prevents the submission of any new customers until all the required elements have been completed in full.

This new and greatly improved ability to screen clients and associated parties for sanctions is highly relevant to the growth markets that our client operates in. Now with streamlined onboarding coupled with regular ongoing screening, the compliance team will be alerted within 24 hours of any existing client becoming sanctioned or added to a watchlist.

In addition, KYC360 Onboarding delivers the ability to view and extract customer details whenever desired, adding an extra layer of functionality to the entire onboarding and screening processes.

This also enables compliance teams to collate the extracted report together with all documents, sanctions details, and all the information from the application pack, in order to send it on to the board of directors for final approval.

Armed with the new technology offered by KYC360 Onboarding, the MLRO has been able to pull all the offices into line, making all compliance requirements mandatory across the board for both know your customer (KYC) and know your business (KYB) elements.

The level of risk across the entire organisation is now fully catalogued and visible to all authorised internal stakeholders. Furthermore, it enables our client to clearly demonstrate to any regulatory bodies that it is taking all the necessary steps to screen for potential risk.

To add to its appeal, this leading-edge solution does away with the complexity of having to manage multiple processes by delivering a single package, from a single supplier, and all under a single licence.

With KYC360 Onboarding in place, our client now has the peace of mind that comes with the knowledge that it now has a comprehensive onboarding solution that is ready to meet both present and future challenges.

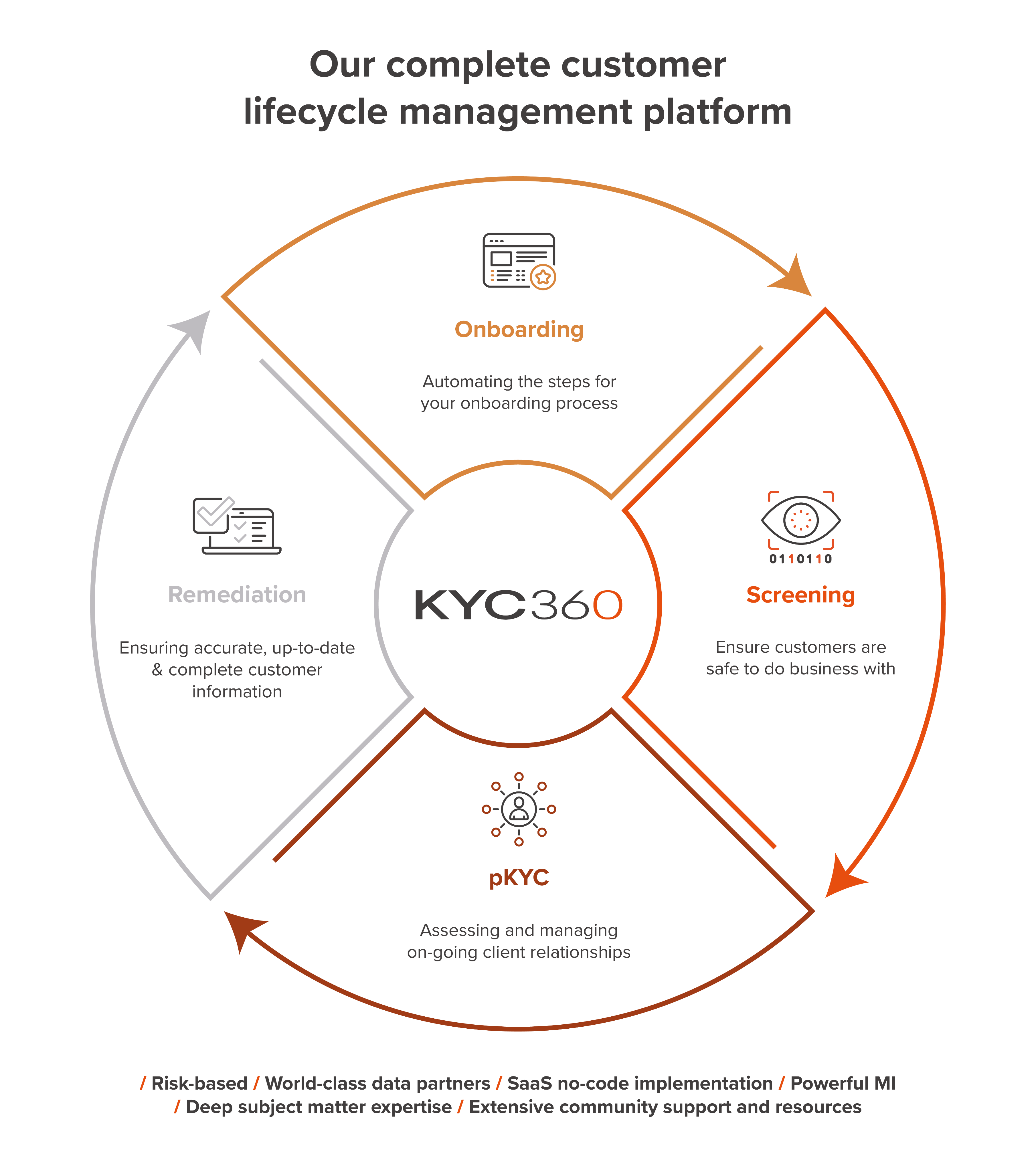

Comply and Outperform with our CLM Platform

|

Reduce time to value, enhance customer experience and drive operational efficiencies with solutions designed by industry experts. Transform your compliance processes into a competitive advantage with KYC360’s award-winning technology. KYC360’s suite of Customer Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards. Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, pKYC and Screening tasks featuring pre-integrated data sources under a single license agreement. Architected for rapid deployment with guaranteed rapid ROI the KYC360 end-to-end no-code SaaS platform is flexible, fully configurable and modular so that you option and pay only for the functionality you need.

|

|