About the Client

Established in 2018 through the consolidation of four carefully selected businesses with over 65 years of experience between them, today the Oak Group is a cohesive, forward-looking organisation with a solid set of values and a strong sense of purpose.

Headquartered in Guernsey, this private client, corporate services, and fund administration business is very much a people-first organisation. As a result, the Oak Group continually strives to create an environment where its 200 employees can thrive in order to deliver exceptional financial solutions to its growing client base.

In addition to looking after its employees, the business also cares deeply for the planet and as a result has placed sustainability at the core of everything it does, from its relationships with all stakeholders to how it undertakes the management of wealth.

This approach also inspires and influences its clients to deliver a better, braver, and more transparent service. This extends to promoting positive social and environmental outcomes wherever the Oak Group conducts its business, while also ensuring that it always meets the statutory regulations in every jurisdiction that it operates in.

The Challenge

The Challenge

As the Oak Group was the result of the coming together of four separate businesses, not surprisingly each carried the legacy of a completely different set of compliance processes and procedures.

Some offices were employing outdated processes that required their compliance teams to spend a great deal of time visiting multiple sanctions and watch list websites, then manually collating all the information. These laborious and time-consuming processes were being constantly repeated, not just for the initial screening and transaction trigger events, but also when conducting periodic reviews.

This complexity resulted in compliance teams finding it hard to manage and understand the outcomes of their endeavours. But having used these processes for many years, one of the main challenges was to get every office to see the value and efficiencies that would result from updating their existing processes.

To add to this challenge, the business operates internationally, thereby presenting many different levels of risk when screening clients as the know your customer (KYC) requirements differ greatly depending on the jurisdictions involved.

Consequently, clients needed to be assessed using a risk-based approach covering a range of different factors. This would be a crucial step if every office were to meet the statutory anti-money laundering (AML) requirements and regulations in every jurisdiction that they operate in, not to mention avoiding exposure to illegal activities.

With a growing client base spread over multiple geographic jurisdictions, Catherine Pigeon, the Oak Group’s Chief Risk & Compliance Officer, realised that there was an urgent requirement for all offices to update and automate their existing processes.

The group required a solution that could far more accurately identify and screen clients while also presenting every office and all staff with a unified and truly global view of risk.

Furthermore, with the 200 staff members operating across its global operations, Oak also required a solution that could be easily and seamlessly accessible by all stakeholders, regardless of their geographical location.

As a result, Catherine was tasked with bringing all the offices into line with a unified, overarching compliance programme that would meet both existing and future needs.

The Solution: Screening

The Solution: Screening

After a thorough review of the options available, via a selection process, Oak found the solution they were looking for in KYC360 Screening.

These best-of-breed tools have been developed using the vast experience gained from conducting regulatory investigations and are served by world-class data providers including Dow Jones and LSEG World-Check.

They also offer a unique 3D risk-based approach that can deliver up to 95% reduction in false positives, thereby saving a huge amount of time by helping to manage risk more efficiently.

With the latest automated processes in place, it would not only enable Oak to screen its clients more effectively and accurately, but also to continually update its data in order to further improve the accuracy of the results.

This, combined with the fact that the tools are intuitive and easy to use, means that not only are all the offices greatly reducing risk, but they are also reducing the delays in detecting compliance concerns.

The flexibility of these intelligent solutions was one of the key factors that persuaded Oak that this solution would meet its needs, while also helping every office to realise the value of a multi-layered approach to risk.

KYC360 Screening would allow all compliance teams to undertake ad hoc screening and would enable them to employ ongoing overnight screening at scale, combining to deliver a truly comprehensive screening to help ensure the business avoids working with the wrong type of client.

With the solution agreed, the KYC360 team set about working closely with Catherine and key members of the compliance teams throughout the initial analysis and design stage. This was to ensure that the KYC360 team fully understood the nature of Oak’s business and that all their compliance teams would be able to make the most of the new technology.

The implementation of the KYC360 solution then proceeded as planned and was rolled out across the group. As well as upgrading the screening processes of every office, additional benefits included: the consolidation of their tech stack; the removal of data silos across the different offices; more collaborative working; and improved AML risk governance through full audit capture and comprehensive MI reporting.

The Results

The Results

The implementation of KYC360 Screening has transformed the entire group’s outdated screening processes into a comprehensive automated digital solution fit for purpose.

Unlike the cumbersome, disjointed processes employed previously, the new solution now delivers a universal view of risk that is shared by all the offices across the group.

Equally importantly, it has provided every single user with an intuitive and clear window into the risk profiles of their clients, and a single source of truth for all stakeholders regardless of their geographic location.

Any reservations from individual offices were quickly dispelled once they saw a demonstration of the solution’s ease of use, the efficiencies that were going to be gained, and most importantly the fact that their statutory obligations were going to be met far more effectively than previously.

The new solution also provides the ability to view and extract customer details whenever required, adding an extra layer of functionality to the entire screening process.

By implementing KYC360 across every office, the Oak Group also enjoys greater efficiencies by avoiding the unnecessary duplication of screening for clients that offices had in common.

As a result, all stakeholders are now seeing the same standard of results, making it easier to see how to continually improve screening practices and deliver even greater unity among the offices.

The level of risk across the entire group is now fully catalogued and visible to all authorised users. Furthermore, it enables the business to clearly demonstrate to any regulatory bodies that it is taking all the necessary steps to screen for potential risk.

And as the compliance teams’ understanding of the overall landscape improves, they will be positioned to make even more accurate decisions in the future.

To add to its appeal, this leading-edge solution does away with the complexity of having to manage multiple processes by delivering a single package, from a single supplier, under a single licence.

Another very valuable point is that it doesn’t require a seasoned compliance professional to analyse the results. In fact, because of its flexibility and ease of use it produces intelligent outputs that most parts of the business can interpret.

Now add to this the solution’s role-based view, editing, and reporting permissions, and it has enabled the offices to distribute the work to more of their colleagues and thereby further socialise the compliance process.

Last, but by no means least, Oak now has the peace of mind that every office now has in place a world-leading screening solution that is ready to meet both present and future challenges.

With the new solution in place Catherine has successfully unified the compliance requirements across the Oak Group, resulting in every office being in a far better position to ensure they always do the right business with the right people.

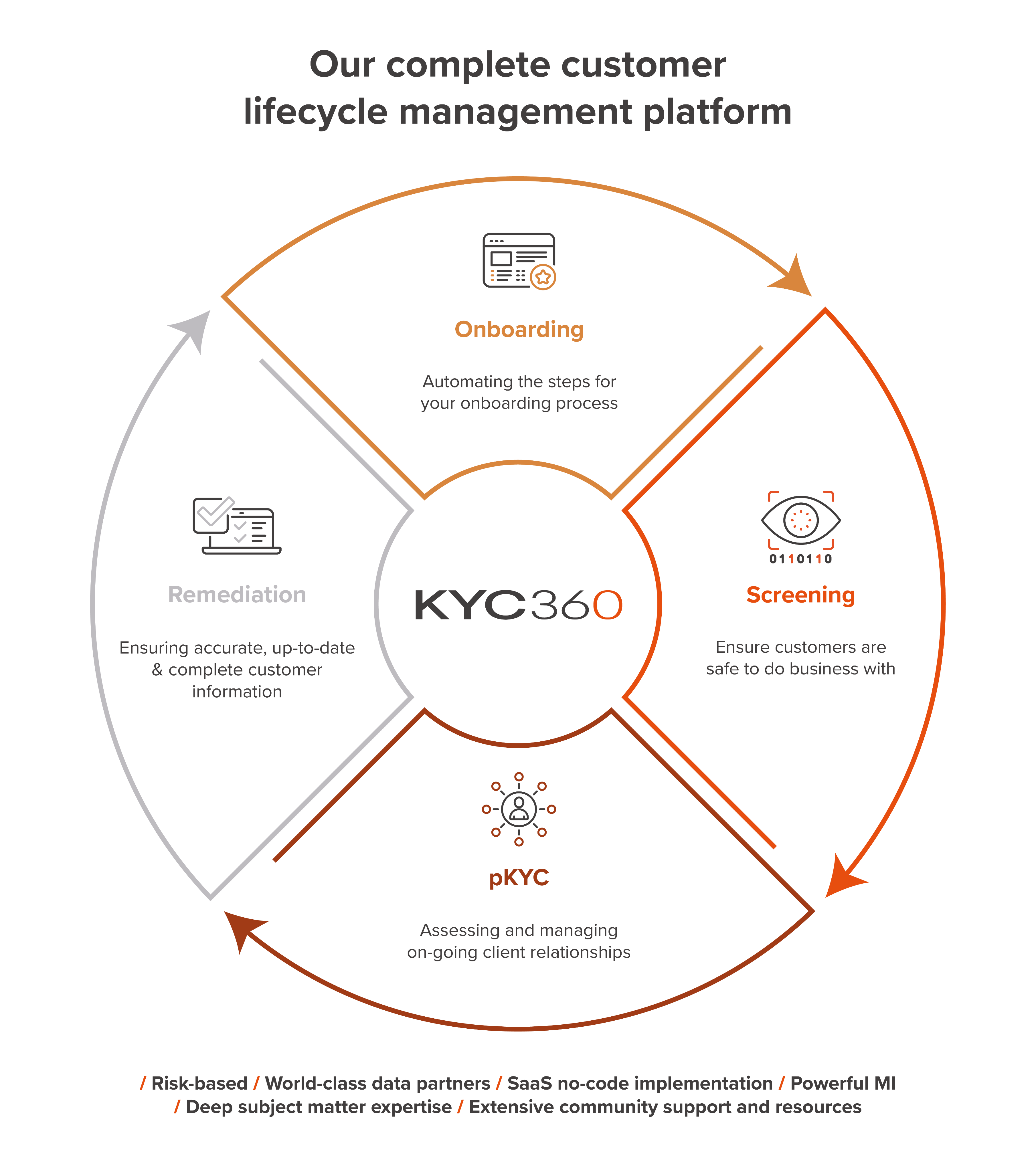

Comply and Outperform with our CLM Platform

|

Reduce time to value, enhance customer experience and drive operational efficiencies with solutions designed by industry experts. Transform your compliance processes into a competitive advantage with KYC360’s award-winning technology. KYC360’s suite of Customer Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards. Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, pKYC and Screening tasks featuring pre-integrated data sources under a single license agreement. Architected for rapid deployment with guaranteed rapid ROI the KYC360 end-to-end no-code SaaS platform is flexible, fully configurable and modular so that you option and pay only for the functionality you need.

|

|