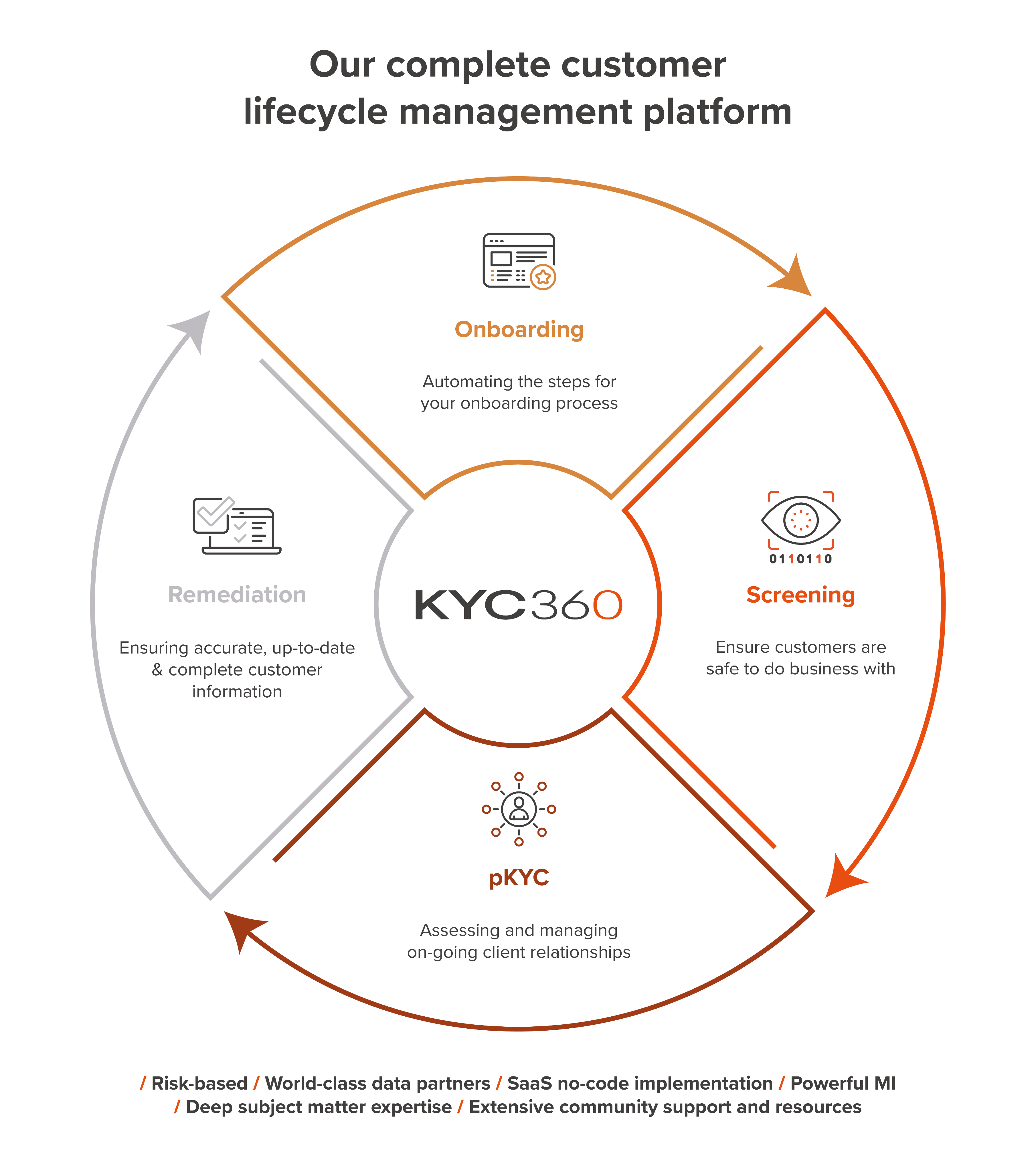

Solutions Overview

Onboarding

Make the right first impression with an award-winning solution that enables you to drive efficiencies and deliver superior customer experiences.

Screening

Whether you need to do the occasional ad-hoc screening check or monitor millions of customers overnight, trust KYC360’s risk-based approach.

pKYC

Dynamically maintain accurate KYC information for your customers throughout business relationships to proactively foster trust.

Remediation

Automate customer remediation with an integrated full-stack solution to avoid previously time-consuming tasks for increased peace of mind.