pKYC

Countless regulatory enforcement actions across the globe have resulted from failure by businesses to dynamically maintain accurate KYC information for their customers during the lifecycle of business relationships.

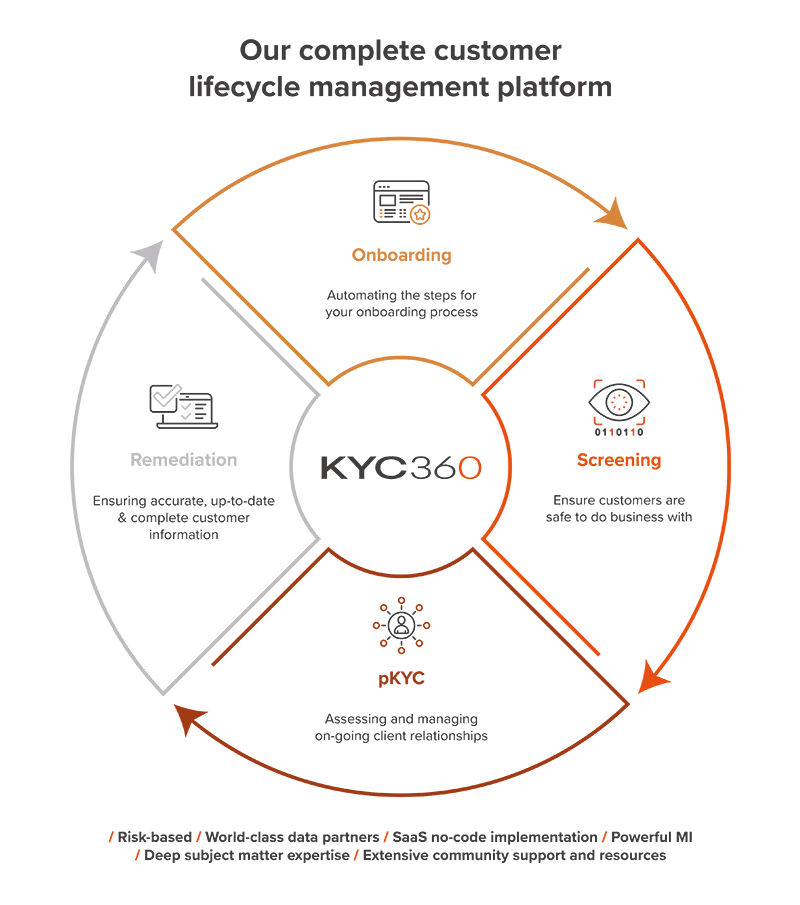

The pKYC solution links seamlessly with the Onboarding and Screening solutions to deliver an end-to-end process that allows you to digitally manage customer KYC automatically in a fully risk based and compliant manner.

Capable of automating KYC dynamically for large volumes of customers allowing you to benefit from massive operational efficiencies, improved CX and a higher level of compliance assurance.

Benefits

KYC360’s suite of Client Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards.