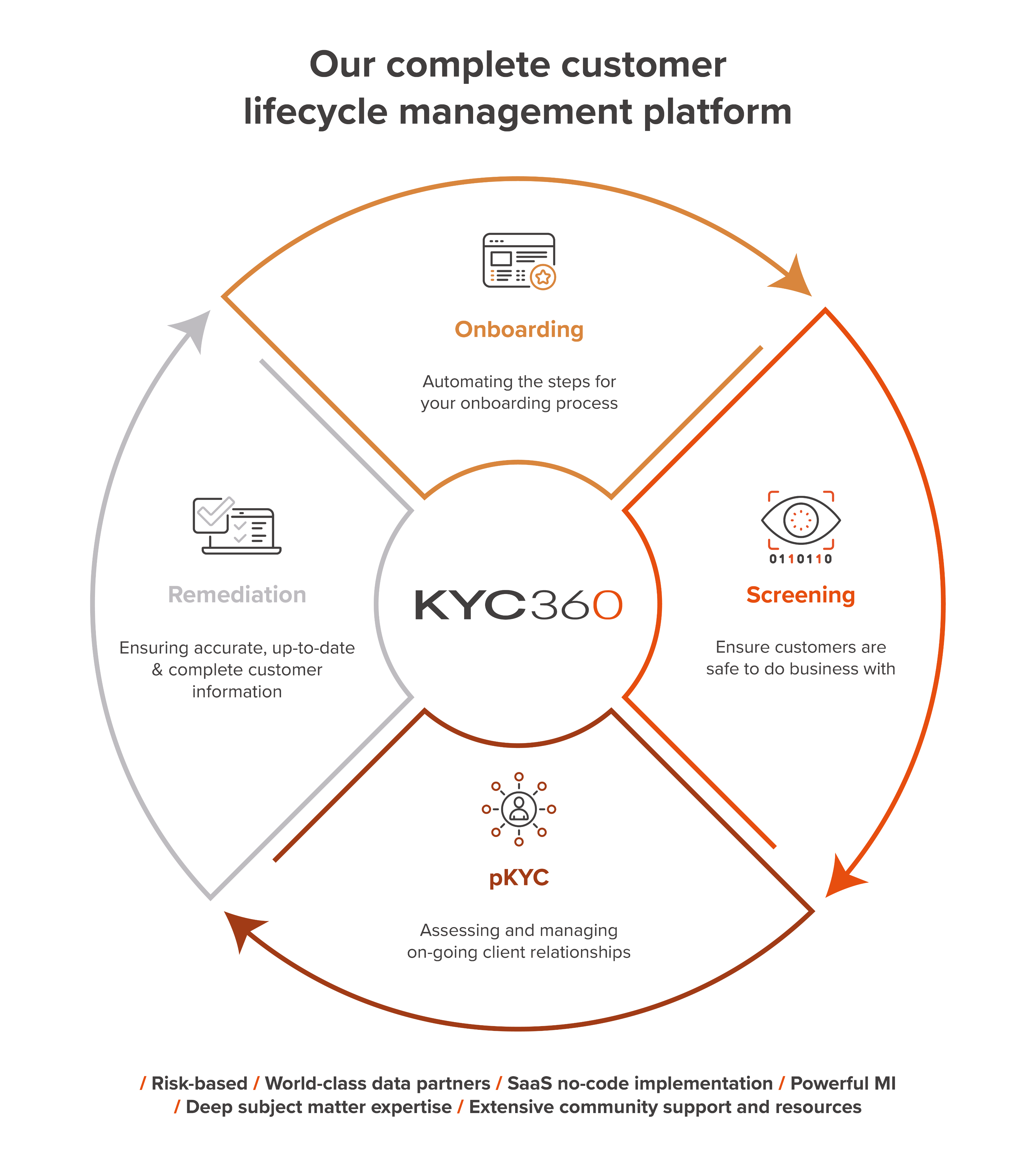

Onboarding

Create the right first impression with your clients and reduce time to revenue with our market leading, dynamic digital onboarding solution. Whether your challenge is retail onboarding at scale or navigating highly complex client relationships, our flexible, award-winning solution will enable you to drive efficiencies and deliver superior customer experience.

The end-to-end KYC360 platform enables screening and CLM to be added seamlessly to your onboarding flows.

Benefits & Features

Onboarding complex clients

Onboarding complex client entities is challenging due to the intricate and interconnected nature of underlying business structures. As a result, the process is often slow, linear and frustrating for all parties.

We’ve reimagined the complex client onboarding process by applying cutting edge technology to solve the most difficult onboarding challenge faced by the financial services industry. Our flexible architecture simplifies the task of onboarding trust, fund, corporate and other complex entity types. Available out of the box as a white-label platform with full no-code configuration.

- Reduce time to revenue for complex client prospects by up to 80%

- Improve customer experience by reducing the number of touchpoints, through dynamic forms and automated entity creation

- Visualise complex client structures and validate with know your business (KYB) sources

- Flexible risk scoring adapts to your risk appetite at both a member and a structure level

- Rapid data waterfall across multiple vendors to reduce cost and optimise first-time pass rates

Digital onboarding at scale

At KYC360 we understand that rapid onboarding of high volumes of customers cannot compromise compliance. Speed, scale and compliance are all critical. Onboarding at scale is about so much more than processing power and system resources. To be truly effective every aspect of the process must be optimised ensuring low latency, maximum STP and quality CX.

- Fully automated, risk-based, straight-forward process

- Granular configuration of pass/fail conditions in automated onboarding flows

- Automatic risk engine for live risk scoring of prospects

- Dynamic forms optimise prospect experience by requesting only essential data

- Slick workflow for rapid case resolution where analyst review is required

- Branded email templates with mail merge for rapid automated outreach

- Rapid data waterfall across multiple vendors to reduce cost and optimise first-time pass rates

KYC360’s suite of Client Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards.